Hot Honey Garlic Chicken Sandwiches<br /> https://www.hellofresh.com/recipes/market/hot-honey-garlic-chicken-sandwiches-62d736a5e50bdd37fa0a23dc

- Jan 2026

- Dec 2025

-

www.c-lineproducts.com www.c-lineproducts.com

-

https://www.c-lineproducts.com/

Name tags that read: "Hello, My Name is" were launched by C-Line in 1959.

Tags

Annotators

URL

-

- Sep 2025

-

angelbravo.cloud angelbravo.cloud

-

Hello Everyone

-

- Jun 2024

-

www.unodc.org www.unodc.org

-

Background Synthetic cathinones are β-keto phenethylamines and chemically similar to amphetamine and methamphetamine [1]. Cathinone, the principal active ingredient in the leaves of the khat plant (catha edulis), can be considered as the prototype from which a range of synthetic cathinones have been developed. Internationally controlled substances in this group are cathinone, methcathinone, cathine and pyrovalerone. Cathinone and methcathinone are listed in Schedule I of the 1971 Single Convention on Psychotropic Substances, cathine in Schedule III and pyrovalerone in Schedule IV. Synthetic cathinones appeared in drug markets in the mid-2000s. In 2005, methylone, an analogue of MDMA, was the first synthetic cathinone reported to the European Monitoring Centre on Drugs and Drug Addiction (EMCDDA). In 2007, reports of 4-methylmethcathinone (mephedrone) use emerged, first in Israel and then in other countries and regions, including Australia, Scandinavia, Ireland and the United Kingdom [2]. Mephedrone was reportedly first synthesized in 1929 [3].

MDMA-assisted therapy for severe PTSD: a randomized, double-blind, placebo-controlled phase 3 study

- Jennifer M. Mitchell,

- Michael Bogenschutz,

- Alia Lilienstein,

- Charlotte Harrison,

- Sarah Kleiman,

- Kelly Parker-Guilbert,

- Marcela Ot'alora G.,

- Wael Garas,

- Casey Paleos,

- Ingmar Gorman,

- Christopher Nicholas,

- Michael Mithoefer,

- Shannon Carlin,

- Bruce Poulter,

- Ann Mithoefer,

- Sylvestre Quevedo,

- Gregory Wells,

- Sukhpreet S. Klaire,

- Bessel van der Kolk,

- Keren Tzarfaty,

- Revital Amiaz,

- Ray Worthy,

- Scott Shannon,

- Joshua D. Woolley,

- ...

- Rick Doblin

Show authors

Nature Medicine volume 27, pages1025--1033 (2021)Cite this article

-

626k Accesses

-

437 Citations

-

4858 Altmetric

Matters Arising to this article was published on 11 October 2021

Matters Arising to this article was published on 11 October 2021

Abstract

Post-traumatic stress disorder (PTSD) presents a major public health problem for which currently available treatments are modestly effective. We report the findings of a randomized, double-blind, placebo-controlled, multi-site phase 3 clinical trial (NCT03537014) to test the efficacy and safety of 3,4-methylenedioxymethamphetamine (MDMA)-assisted therapy for the treatment of patients with severe PTSD, including those with common comorbidities such as dissociation, depression, a history of alcohol and substance use disorders, and childhood trauma. After psychiatric medication washout, participants (n = 90) were randomized 1:1 to receive manualized therapy with MDMA or with placebo, combined with three preparatory and nine integrative therapy sessions. PTSD symptoms, measured with the Clinician-Administered PTSD Scale for DSM-5 (CAPS-5, the primary endpoint), and functional impairment, measured with the Sheehan Disability Scale (SDS, the secondary endpoint) were assessed at baseline and at 2 months after the last experimental session. Adverse events and suicidality were tracked throughout the study. MDMA was found to induce significant and robust attenuation in CAPS-5 score compared with placebo (P < 0.0001, d = 0.91) and to significantly decrease the SDS total score (P = 0.0116, d = 0.43). The mean change in CAPS-5 scores in participants completing treatment was -24.4 (s.d. 11.6) in the MDMA group and -13.9 (s.d. 11.5) in the placebo group. MDMA did not induce adverse events of abuse potential, suicidality or QT prolongation. These data indicate that, compared with manualized therapy with inactive placebo, MDMA-assisted therapy is highly efficacious in individuals with severe PTSD, and treatment is safe and well-tolerated, even in those with comorbidities. We conclude that MDMA-assisted therapy represents a potential breakthrough treatment that merits expedited clinical evaluation.

Similar content being viewed by others

MDMA-assisted therapy for moderate to severe PTSD: a randomized, placebo-controlled phase 3 trial

Article Open access14 September 2023

Trauma-focused treatment for comorbid post-traumatic stress and substance use disorder

Article 14 November 2022

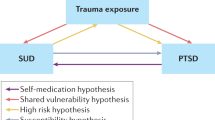

Behavioral and neurocognitive factors distinguishing post-traumatic stress comorbidity in substance use disorders

Article Open access14 September 2023

Main

PTSD is a common and debilitating condition with immeasurable social and economic costs that affects the lives of hundreds of millions of people annually. There are a number of environmental and biological risk factors that contribute to the development and maintenance of PTSD1, and poor PTSD treatment outcomes are associated with several comorbid conditions that include childhood trauma2, alcohol and substance use disorders3, depression4, suicidal ideation5 and dissociation6. It is therefore imperative to identify a therapeutic that is beneficial in those individuals with the comorbidities that typically confer treatment resistance.

The selective serotonin reuptake inhibitors (SSRIs) sertraline and paroxetine are Food and Drug Administration (FDA)-approved first-line therapeutics for the treatment of PTSD. However, an estimated 40--60% of patients do not respond to these compounds7. Likewise, although evidenced-based trauma-focused psychotherapies such as prolonged exposure and cognitive behavioral therapy are considered to be the gold standard treatments for PTSD8, many participants fail to respond or continue to have significant symptoms, and dropout rates are high9,10. Novel cost-effective therapeutics are therefore desperately needed11.

The substituted amphetamine 3,4-methylenedioxymethamphetamine (MDMA) induces serotonin release by binding primarily to presynaptic serotonin transporters12. MDMA has been shown to enhance fear memory extinction, modulate fear memory reconsolidation (possibly through an oxytocin-dependent mechanism), and bolster social behavior in animal models13,14. Pooled analysis of six phase 2 trials of MDMA-assisted therapy for PTSD have now shown promising safety and efficacy findings15.

Here, we assess the efficacy and safety of MDMA-assisted therapy in individuals with severe PTSD. Participants were given three doses of MDMA or placebo in a controlled clinical environment and in the presence of a trained therapy team. Primary and secondary outcome measures (CAPS-5 and SDS, respectively) were assessed by a centralized pool of blinded, independent diagnostic assessors. MDMA-assisted therapy for PTSD was granted an FDA Breakthrough Therapy designation, and the protocol and statistical analysis plan (SAP) were developed in conjunction with the FDA16.

Results

Demographics

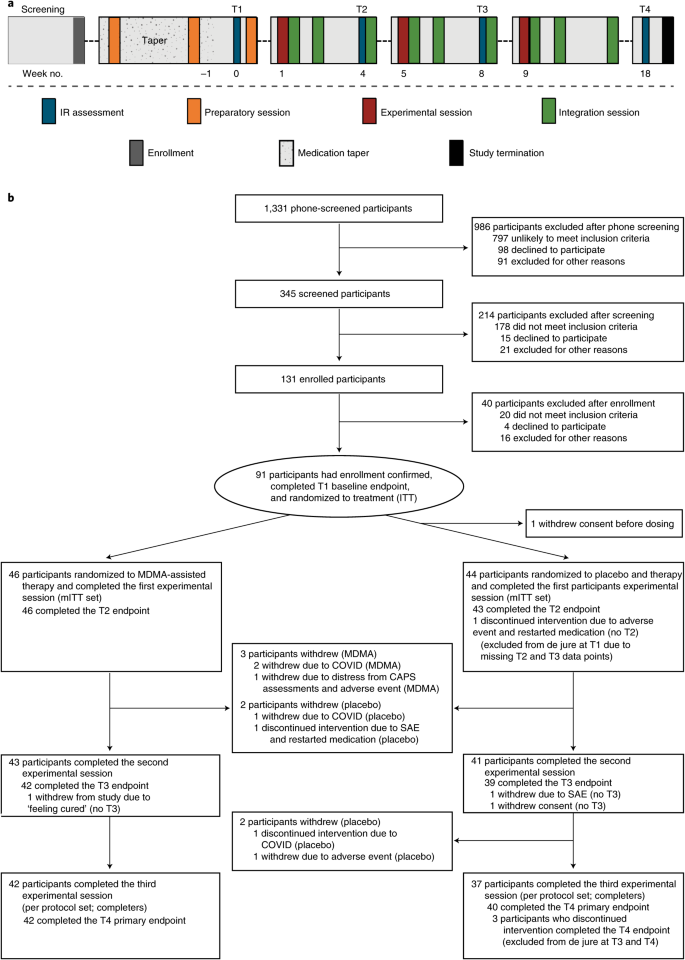

Participants were recruited from 7 November 2018 to 26 May 2020, with the last participant visit conducted on 21 August 2020. A total of 345 participants were assessed for eligibility, 131 were enrolled, 91 were confirmed for randomization (United States, n = 77; Canada, n = 9; Israel, n = 5), and 46 were randomized to MDMA and 44 to placebo (Fig. 1).

Fig. 1: Procedure timeline and study flow diagram.

a, Procedure timeline. Following the screening procedures and medication taper, participants attended a total of three preparatory sessions, three experimental sessions, nine integration sessions and four endpoint assessments (T1--4) over 18 weeks, concluding with a final study-termination visit. IR, independent rater; T, timepoint of endpoint assessment; T1, baseline; T2, after the first experimental session; T3, after the second experimental session; T4, 18 weeks after baseline. b, CONSORT diagram indicating participant numbers and disposition through the course of the trial.

Study arms were not significantly different in terms of race, ethnicity, sex, age, dissociative subtype, disability or CAPS-5 score (Table 1). The mean duration of PTSD diagnosis was 14.8 (s.d. 11.6) years and 13.2 (s.d. 11.4) years in the MDMA and placebo groups, respectively. Of note, six participants in the MDMA group and 13 participants in the placebo group had the dissociative subtype according to CAPS-5 score.

Table 1 Demographics and baseline characteristics

Efficacy

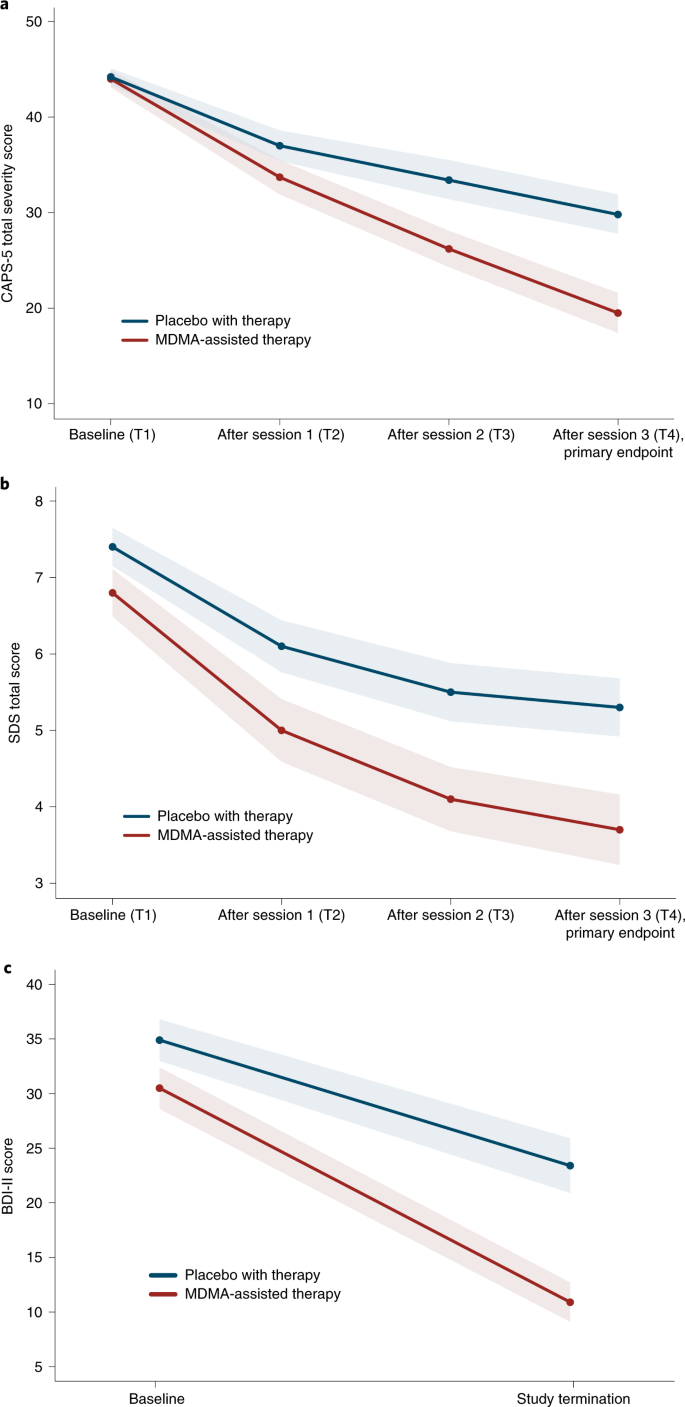

MDMA significantly attenuated PTSD symptomology, as shown by the change in CAPS-5 total severity score from baseline to 18 weeks after baseline. Mixed model repeated measure (MMRM) analysis of the de jure estimand (that is, the effects of the drug if taken as directed) showed a significant difference in treatment arms (n = 89 (MDMA n = 46), P < 0.0001, between-group difference = 11.9, 95% confidence interval (CI) = 6.3--17.4, d.f. = 71) (Fig. 2a). MMRM sensitivity analysis of the de facto estimand (that is, the effects of the drug if taken as assigned, regardless of adherence) showed a significant difference in treatment arms (n = 90, P < 0.0001, d.f. = 72).

Fig. 2: Measures of MDMA efficacy in the MDMA-assisted therapy group and the placebo group.

a, Change in CAPS-5 total severity score from T1 to T4 (P < 0.0001, d = 0.91, n = 89 (MDMA n = 46)), as a measure of the primary outcome. Primary analysis was completed using least square means from an MMRM model. b, Change in SDS total score from T1 to T4 (P = 0.0116, d = 0.43, n = 89 (MDMA n = 46)), as a measure of the secondary outcome. Primary analysis was completed using least square means from an MMRM model. c, Change in BDI-II score from T1 to study termination (t = -3.11, P = 0.0026, n = 81 (MDMA n = 42)), as a measure of the exploratory outcome. Data are presented as mean and s.e.m.

The mean change in CAPS-5 scores from baseline to 18 weeks after baseline in the completers (per protocol set) was -24.4 (s.d. 11.6) (n = 42) in the MDMA-assisted therapy group compared with -13.9 (s.d. 11.5) (n = 37) in the placebo with therapy group.

The effect size of the MDMA-assisted therapy treatment compared with placebo with therapy was d = 0.91 (95% CI = 0.44--1.37, pooled s.d. = 11.55) in the de jure estimand and d = 0.97 (95% CI = 0.51--1.42) in the de facto estimand. When the within-group treatment effect (which included the effect of the supportive therapy that was administered in both arms) was compared between the MDMA and placebo groups, the effect size was 2.1 (95% CI = -5.6 to 1.4) in the MDMA group and 1.2 (95% CI = -4.9 to 2.5) in the placebo group.

Over the same period, MDMA significantly reduced clinician-rated functional impairment as assessed with the SDS. MMRM analysis of the de jure estimand showed a significant difference in treatment arms (n = 89 (MDMA n = 46), P = 0.0116, d.f. = 71, effect size = 0.43, 95% CI = -0.01 to 0.88, pooled s.d. = 2.53) (Fig. 2b). The mean change in SDS scores from baseline to 18 weeks after baseline in the completers was -3.1 (s.d. 2.6) (n = 42) in the MDMA-assisted therapy group and -2.0 (s.d. 2.4) (n = 37) in the placebo with therapy group.

MDMA was equally effective in participants with comorbidities that are often associated with treatment resistance. Participants with the dissociative subtype of PTSD who received MDMA-assisted therapy had significant symptom reduction on the CAPS-5 (mean MDMA Δ = -30.8 (s.d. 9.0), mean placebo Δ = -12.8 (s.d. 12.8)), and this was similar to that in their counterparts with non-dissociative PTSD (mean MDMA Δ = -23.6 (s.d. 11.7), mean placebo Δ = -14.3 (s.d. 11.2)). The benefit of MDMA therapy was not modulated by history of alcohol use disorder, history of substance use disorder, overnight stay or severe childhood trauma. Results were consistent across all 15 study sites with no effect by study site (P = 0.1003). In MMRM analysis there was no obvious impact of SSRI history on effectiveness of MDMA (Supplementary Table 2).

MDMA therapy was effective in an exploratory endpoint analysis of the reduction of depression symptoms (using the Beck Depression Inventory II (BDI-II)) from baseline to study termination of the de jure estimand (mean MDMA Δ = -19.7 (s.d. 14.0), n = 42; mean placebo Δ = -10.8 (s.d. 11.3), n = 39; t = -3.11, P = 0.0026, d.f. = 79, effect size = 0.67, 95% CI = 0.22--1.12) (Fig. 2c).

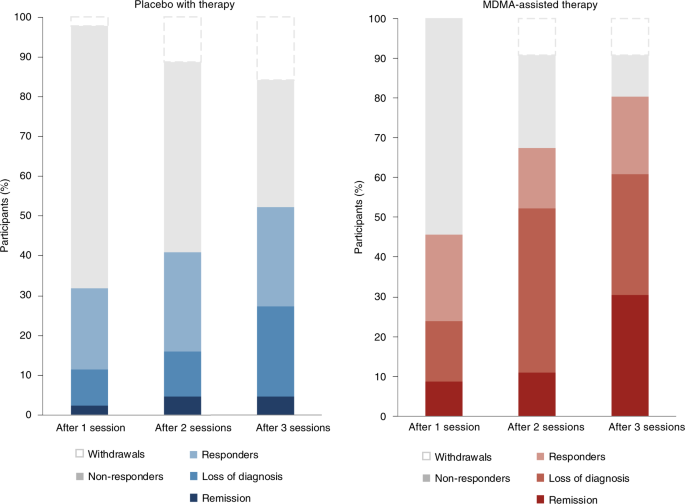

Clinically significant improvement (a decrease of ≥10 points on the CAPS-5), loss of diagnosis (specific diagnostic measure on the CAPS-5), and remission (loss of diagnosis and a total CAPS-5 score ≤ 11) were each tracked. At the primary study endpoint (18 weeks after baseline), 28 of 42 (67%) of the participants in the MDMA group no longer met the diagnostic criteria for PTSD, compared with 12 of 37 (32%) of those in the placebo group after three sessions. Additionally, 14 of 42 participants in the MDMA group (33%) and 2 of 37 participants in the placebo group (5%) met the criteria for remission after three sessions (Fig. 3).

Fig. 3: Treatment response and remission for MDMA and placebo groups as a percentage of total participants randomized to each arm (MDMA, n = 46; placebo, n = 44).

Responders (clinically significant improvement, defined as a ≥10-point decrease on CAPS-5), loss of diagnosis (specific diagnostic measure on CAPS-5), and remission (loss of diagnosis and a total CAPS-5 score of ≤11) were tracked in both groups. Non-response is defined as a <10-point decrease on CAPS-5. Withdrawal is defined as a post-randomization early termination.

Safety

Treatment-emergent adverse events (TEAEs, adverse events that occurred during the treatment period from the first experimental session to the last integration session) that were more prevalent in the MDMA study arm were typically transient, mild to moderate in severity, and included muscle tightness, decreased appetite, nausea, hyperhidrosis and feeling cold (Supplementary Table 3). Importantly, no increase in adverse events related to suicidality was observed in the MDMA group. A transient increase in vital signs (systolic and diastolic blood pressure and heart rate) was observed in the MDMA group (Supplementary Table 4). Two participants in the MDMA group had a transient increase in body temperature to 38.1 °C: one had an increase after the second MDMA session, and one had an increase after the second and third MDMA sessions.

Two participants, both randomized to the placebo group, reported three serious adverse events (SAEs) during the trial. One participant in the placebo group reported two SAEs of suicidal behavior during the trial, and another participant in the placebo group reported one SAE of suicidal ideation that led to self-hospitalization. Five participants in the placebo group and three participants in the MDMA group reported adverse events of special interest (AESIs) of suicidal ideation, suicidal behavior or self-harm in the context of suicidal ideation. One participant in the placebo group reported two cardiovascular AESIs in which underlying cardiac etiology could not be ruled out (Table 2). One participant randomized to the MDMA group chose to discontinue participation due to being triggered by the CAPS-5 assessments and to an adverse event of depressed mood following an experimental session; this participant met the criterion as a non-responder, which was defined as having a less than 10-point decrease in CAPS-5 score. MDMA sessions were not otherwise followed by a lowering of mood.

Table 2 Participants with treatment-emergent SAEs and AESIs

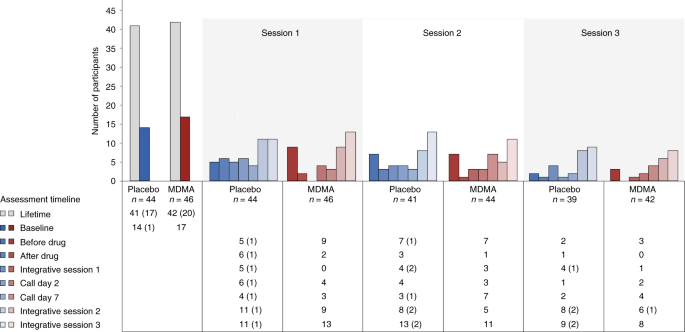

Suicidality was tracked throughout the study using the Columbia Suicide Severity Rating Scale (C-SSRS) at each study visit. More than 90% of participants reported suicidal ideation in their lifetime, and 17 of 46 participants (37%) in the MDMA group and 14 of 44 participants (32%) in the placebo group reported suicidal ideation at baseline. Although the number of participants who reported suicidal ideation varied throughout the visits, prevalence never exceeded baseline and was not exacerbated in the MDMA group. Serious suicidal ideation (a score of 4 or 5 on the C-SSRS) was minimal during the study and occurred almost entirely in the placebo arm (Fig. 4).

Fig. 4: Number of participants reporting the presence of suicidal ideation as measured with the C-SSRS at each visit and separated by treatment group.

C-SSRS ideation scores range from 0 (no ideation) to 5. A C-SSRS ideation score of 4 or 5 is termed 'serious ideation'. The number of participants endorsing any positive ideation (>0) is shown by the colored bars and noted in the table below the graph. The number of participants endorsing serious ideation is given in parentheses in the table.

Discussion

Here, we demonstrate that three doses of MDMA given in conjunction with manualized therapy over the course of 18 weeks results in a significant and robust attenuation of PTSD symptoms and functional impairment as assessed using the CAPS-5 and SDS, respectively. MDMA also significantly mitigated depressive symptoms as assessed using the BDI-II. Of note, MDMA did not increase the occurrence of suicidality during the study.

These data illustrate the potential benefit of MDMA-assisted therapy for PTSD over the FDA-approved first-line pharmacotherapies sertraline and paroxetine, which have both exhibited smaller effect sizes in pivotal studies16. Previous comparison of change in CAPS score between sertraline and placebo showed effect sizes of 0.31 and 0.37 (ref. 16). Similarly, comparison of change in CAPS score between paroxetine and placebo showed effect sizes of 0.56, 0.45 and 0.09 (ref. 16). By contrast, the effect size of 0.91 demonstrated in this study between MDMA-assisted therapy and placebo with therapy was larger than that for any other previously identified PTSD pharmacotherapy16,17,18. To directly assess superiority, a head-to-head comparison of MDMA-assisted therapy with SSRIs for PTSD would be needed. Although the present study tested the effects of MDMA using a model in which both treatment groups received supportive therapy, participants who received MDMA and supportive therapy (d = 2.1) had greater improvement in PTSD change scores compared with those who received placebo with supportive therapy (d = 1.2), suggesting that MDMA enhanced the effects of supportive therapy. In clinical practice, both MDMA and supportive therapy will be components of this PTSD treatment.

Previous research on MDMA for PTSD has suggested that those with a recent history of SSRI treatment may not respond as robustly to MDMA18. Given that 65.5% of participants in the current trial have a lifetime history of SSRI use, it is difficult to separate the ramifications of long-term SSRI treatment from the effects of treatment resistance. However, there was no obvious effect of previous SSRI use on therapeutic efficacy in this trial. Similarly, although years of PTSD diagnosis or age of onset may affect treatment efficacy, no obvious relationship was seen here between duration or onset of PTSD diagnosis and treatment efficacy.

Serotonin and the serotonin transporter are of particular importance in the generation, consolidation, retrieval and reconsolidation of fear memories19,20. Reduced serotonin transporter levels (which result in greater amounts of extracellular serotonin) have been shown to predict propensity to develop PTSD21, increase fear and anxiety-related behaviors22, and induce greater amygdalar blood oxygenation level-dependent (BOLD) activity in response to fearful images23. There is extensive serotonergic innervation of the amygdala, and amygdalar serotonin levels have been shown to increase following exposure to stressful and fear-inducing stimuli24. MDMA enhances the extinction of fear memories in mice through increased expression of brain-derived neurotrophic factor in the amygdala, and human neuroimaging studies have demonstrated that MDMA is associated with attenuated amygdalar BOLD activity during presentation of negative emotional stimuli25. Together these data suggest that MDMA may exert its therapeutic effects through a well-conserved mechanism of amygdalar serotonergic function that regulates fear-based behaviors and contributes to the maintenance of PTSD. Perhaps by reopening an oxytocin-dependent critical period of neuroplasticity that typically closes after adolescence15, MDMA may facilitate the processing and release of particularly intractable, potentially developmental, fear-related memories.

It is intriguing to speculate that the pharmacological properties of MDMA, when combined with therapy, may produce a 'window of tolerance,' in which participants are able to revisit and process traumatic content without becoming overwhelmed or encumbered by hyperarousal and dissociative symptoms26. MDMA-assisted therapy may facilitate recall of negative or threatening memories with greater self-compassion27 and less PTSD-related shame and anger28. Additionally, the acute prosocial and interpersonal effects of MDMA25,29 may support the quality of the therapeutic alliance, a potentially important factor relating to PTSD treatment adherence30 and outcome31. Indeed, clinicians have suggested that "MDMA may catalyze therapeutic processing by allowing patients to stay emotionally engaged while revisiting traumatic experiences without becoming overwhelmed"32.

Given that PTSD is a strong predictor of disability in both veteran and community populations33, it is promising to note that the robust reduction in PTSD and depressive symptoms identified here is complemented by a significant improvement in SDS score (for example, work and/or school, social and family functioning). Approximately 4.7 million US veterans report a service-related disability[34](https://www.nature.com/articles/s41591-021-01336-3#ref-CR34 "Bureau of Labor and Statistics. Employment Situation of Veterans---2020. News release, 18 March 2021; https://www.bls.gov/news.release/pdf/vet.pdf

"), costing the US government approximately $73 billion per year[35](https://www.nature.com/articles/s41591-021-01336-3#ref-CR35 "Congressional Budget Office. Possible Higher Spending Paths for Veterans' Benefits (2018); https://www.cbo.gov/publication/54881 "). Identification of a PTSD treatment that could improve social and family functioning and ameliorate impairment across a broad range of environmental contexts could provide major medical cost savings, in addition to improving the quality of life for veterans and others affected by this disorder.PTSD is a particularly persistent and incapacitating condition when expressed in conjunction with other disorders of mood and affect. In the present study, perhaps most compelling are the data indicating efficacy in participants with chronic and severe PTSD, and the associated comorbidities including childhood trauma, depression, suicidality, history of alcohol and substance use disorders, and dissociation, because these groups are all typically considered treatment resistant2,3,4,5,6. Given that more than 80% of those assigned a PTSD diagnosis have at least one comorbid disorder3, the identification of a therapy that is effective in those with complicated PTSD and dual diagnoses could greatly improve PTSD treatment. Additional studies should therefore be conducted to evaluate the safety and efficacy of MDMA-assisted therapy for PTSD in those with specific comorbidities.

Although recent research suggests that dissociative subtype PTSD is difficult to treat36, participants with the dissociative subtype who received MDMA-assisted therapy had significant symptom reduction that was at least similar to that of their counterparts with non-dissociative PTSD. Given that this covariate was significant, it warrants further study. Furthermore, given that other treatments for PTSD are not consistently effective for those with the dissociative subtype, these data, if replicated, would indicate an important novel therapeutic niche for MDMA-assisted therapy for typically hard-to-treat populations.

Importantly, there were no major safety issues reported in the MDMA arm of this study. Although abuse potential, cardiovascular risk and suicidality were recorded as AESIs, MDMA was not shown to induce or potentiate any of these conditions. In addition, although there was often a transient increase in blood pressure during MDMA sessions, this was expected based on phase 2 data and previous studies in healthy volunteers37. These data suggest that MDMA has an equivalent, if not better, safety profile compared with that of first-line SSRIs for the treatment of PTSD, which are known to carry a low risk of QT interval prolongation38.

There are several limitations to the current trial. First, due to the coronavirus disease 2019 (COVID-19) pandemic, the participant population is smaller than originally planned. However, given the power noted in this study, it is unlikely that population size was an impediment. Second, the population is relatively homogeneous and lacks racial and ethnic diversity, which should be addressed in future trials. Third, this report describes the findings of a short-term pre-specified primary outcome, 2 months after the last experimental session and 5 weeks since the final integrative therapy session; long-term follow-up data from this controlled trial will be collected to assess durability of treatment. Fourth, safety data were by necessity collected by site therapists, perhaps limiting the blinding of the data. To eliminate this effect on the primary and secondary outcome measures, all efficacy data were collected by blinded, independent raters. Last, given the subjective effects of MDMA, the blinding of participants was also challenging and possibly led to expectation effects14. However, although blinding was not formally assessed during the study, when participants were contacted to be informed of their treatment assignment at the time of study unblinding it became apparent that at least 10% had inaccurately guessed their treatment arm. Although anecdotal, at least 7 of 44 participants in the placebo group (15.9%) inaccurately believed that they had received MDMA, and at least 2 of 46 participants in the MDMA group (4.3%) inaccurately believed that they had received placebo.

We may soon be confronted with the potentially enormous economic and social repercussions of PTSD, exacerbated by the COVID-19 pandemic. Overwhelmingly high rates of psychological and mental health impairment could be with us for years to come and are likely to impart a considerable emotional and economic burden. Novel PTSD therapeutics are desperately needed, especially for those for whom comorbidities confer treatment resistance.

In summary, MDMA-assisted therapy induces rapid onset of treatment efficacy, even in those with severe PTSD, and in those with associated comorbidities including dissociative PTSD, depression, history of alcohol and substance use disorders, and childhood trauma. Not only is MDMA-assisted therapy efficacious in individuals with severe PTSD, but it may also provide improved patient safety. Compared with current first-line pharmacological and behavioral therapies, MDMA-assisted therapy has the potential to dramatically transform treatment for PTSD and should be expeditiously evaluated for clinical use.

-

- Jan 2024

-

- Sep 2023

-

-

the way you say hello in humpback whale is oh

- for: humpback whale - saying hello, animal communication, whale communication

-

- Aug 2023

-

www.si.edu www.si.edu

-

In 1970 Diller starred as Dolly Gallagher Levi in Hello, Dolly! for three months at the St. James Theatre on Broadway. Diller followed Carol Channing, Ginger Rogers, Martha Raye, Pearl Bailey (in a version with an all-black cast) and Betty Grable in the role and was replaced by Ethel Merman, who closed out the show in December 1970.

-

- Apr 2023

-

hypothes.is hypothes.is

-

Create a note by selecting some text and clicking the button

This is my first annotation. Hello World.

Tags

Annotators

URL

-

- Mar 2022

-

type.cyhsu.xyz type.cyhsu.xyz

-

Hello 我是因为你的介绍用上 Hypothesis 的,感觉不错,谢谢!

Tags

Annotators

URL

-

- Nov 2021

-

hypothes.is hypothes.is

-

any annotations yet.

Hello

-

- Aug 2021

-

www.publishthis.email www.publishthis.email

-

Re: 💡The week that crypto grew up reading this, lmk if you ACK maSYNOn Thu, Aug 12, 2021 at 11:06 AM Azeem Azhar via LinkedIn <newsletters-noreply@linkedin.com> wrote: Hi, I found it weird that the US infrastructure bill included so much, often... Adam Marshall Dobrin NEWSLETTER ON LINKEDIN Exponential View on LinkedIn By Azeem Azhar Open this article on LinkedIn to see what people are saying about this topic. Open on LinkedIn 💡The week that crypto grew up Hi, I found it weird that the US infrastructure bill included so much, often cacophonous detail, about crypto, but the ways of politics can be long-winded. The topic was important enough so I sought out the best person who could help us understand what was going on. EV member, Kevin Werbach is an erstwhile regulator, with a stint at the FCC when regulating the Internet was under discussion in the mid-1990s. He is also the author of one of the clearest books on the blockchain. Kevin also edited EV in August 2019 when I was on holiday. Please take a moment to thank Kevin and share his essay. Since this piece was first published earlier this week, the Senate passed a $1.2 trillion infrastructure package as originally introduced a week before. The House of Representatives has the next vote, and there is bipartisan support for amending the bill, which might include amendments pushed for by the crypto community and lobbyists. For a timeline of what happened in the past two weeks, see this. This essay was first published earlier this week to members of Exponential View. If you'd like to receive regular analysis of our shapeshifting world, become our member. Azeem ------ This past week in Washington DC, an unstoppable force met an immovable object. The result wasn’t what you might expect. Blockchains and cryptocurrencies are often described as unstoppable, because their decentralized networks cannot be shut down and their smart contract transactions cannot be reversed. On the other side, policy-makers and regulators are seen as immovable, either because they bring to bear the coercive power of the state, or because they are simply too slow and dim-witted to adapt with the times. Both views are exaggerations, of course. Progress occurs when discussions descend from ideologies to practicalities. The immediate controversy was obscure: a provision in the Biden Administration’s mammoth infrastructure bill defining cryptocurrency exchanges as “brokers” subject to tax reporting. Tightening up crypto trading tax compliance would supposedly raise $30 billion to offset spending. The language, though, was vague. It arguably could have swept in miners, wallet software or hardware providers, and others who couldn’t do tax accounting for customers if they tried. Amendments were offered. Followed by counter-amendments. Followed by a flurry of lobbying and back-channel conversations. In the end, a compromise was reached, and then struck from the bill in an unrelated fight over military spending. That the fight ended (for now) not with a bang but with a whimper should be cause for celebration. It’s proof that legislators, even in the deeply polarized United States, can come together across party lines to address a highly technical issue related to a fast-developing new industry. Two other implications stand out. First, crypto has arrived as a political force. Tech policy may never be the same. It was 26 years ago that a motley collection of activists and public interest organizations literally turned most of the popular pages on the World Wide Web black to protest the US Communications Decency Act. Their advocacy during the legislative process attracted attention. It helped spur a bipartisan amendment, Section 230, that gave service providers protection to innovate, and became a cornerstone of internet policy. (Albeit a controversial one today!) A unanimous Supreme Court struck down the remainder of the law. Since then, the Internet community has had seats at the table on important policy battles. Given its libertarian bent, the crypto community has often bridled at engaging with governments. Fortunately, organizations such as Coin Center, the Chamber of Digital Commerce, and the Blockchain Association, all of which were involved in the infrastructure bill negotiations, took a more pragmatic view. Given its growing financial heft, the crypto community can be a powerful force for pro-innovation reform and individual empowerment in public policy debates. That is, if it can overcome its tendency to dismiss legitimate concerns about money laundering, fraud, and financial stability as craven excuses to protect incumbents. The second takeaway is that the real fight over crypto is yet to come. The true point of contention around the infrastructure bill wasn’t over shutting down Bitcoin or other digital assets (which no one was arguing), nor was it over whether crypto traders should have to pay taxes on their gains (which no one opposed). It was over something not mentioned in the bill at all: decentralized finance, or DeFi. DeFi is a fast-growing sector of decentralized applications performing financial services functions such as lending and trading. From less than $1 billion at the start of 2020, DeFi protocols now manage roughly $60 billion of digital assets, with even bigger numbers when counting adjacent areas such as stablecoins, and non-fungible tokens (NFTs) for digital artwork and collectables. While it’s an exciting market, it’s also a growing source of worry for regulators. DeFi protocols serve anyone indiscriminately (creating a challenge for financial crime and securities regulation), open up a host of vulnerabilities (resulting in hundreds of millions of dollars worth of losses already from hacks), create significant opportunities for scams, and generate interconnected risks that pose financial stability concerns. The biggest problem with DeFi is that it potentially eliminates any touchpoint for regulation. Who is responsible when a service is a set of smart contracts running on their own on a blockchain? Janet Yellen’s Treasury department didn’t want to take DeFi regulation off the table with language that exempted developers and facilitators of those protocols. The battle is coming, though. In Europe, it’s already here, with the proposed Markets in Crypto-Assets Regulation (MiCA) framework. Whether one is an enthusiast or sceptic of crypto, the genie is out of the bottle. DeFi services will be deployed. Even with a major crash, there will be hundreds of billions of dollars of digital assets available to interact with them. It is difficult to write language covering DeFi facilitators that doesn’t produce harmful spillovers in terms of government surveillance, speech regulation, and chilled innovation. This is the 20-year-old battle over peer-to-peer file-sharing reborn, with the stakes far greater. The good news is that enough of the crypto community seems to be growing up. At the same time, governments are recognizing that the Trump Administration’s strategy of doing nothing is actually long-term harmful to nascent industries. Regulatory uncertainty creates what Nobel Laureate (and Secretary Yellen’s spouse) George Akerlof called the market for lemons; it removes the advantage of responsible actors, who are then crowded out by the bad apples. For all its messiness and unsatisfying ending, the recent crypto controversy in Washington is a hopeful indication that we may yet follow a different path. Kevin ---- Kevin Werbach is a professor of Legal Studies and Business Ethics at the Wharton School, University of Pennsylvania, and formerly Counsel for New Technology Policy at the U.S. Federal Communications Commission. Kevin has spent the past two decades exploring major trends at the intersection of the Internet, digital media, and communications. He served on the Obama Administration's Presidential Transition Team and founded the Supernova Group. He has published four books, including The Blockchain and the New Architecture of Trust, For the Win: The Power of Gamification and Game Thinking in Business, Education, Government, and Social Impact, and After the Digital Tornado: Networks, Algorithms, Humanity. Dig deeper: Decentralised Finance (DeFi) Policy-Maker Toolkit (WEF in collaboration with the Wharton Blockchain and Digital Asset Project, 2021) Banking Without Banks: Decentralised Finance is Coming (Exponential View Podcast, 2021) Bitcoin and the Future of Decentralised Finance (Exponential View Podcast, 2021) Join the conversation Know someone who might be interested in this newsletter? Share it with them. Unsubscribe | Help You are receiving LinkedIn notification emails. The newsletter author can see that you are a subscriber. This email was intended for Adam Marshall Dobrin (Creative Director and ... Backseat Ferryman at XCALIBER DAO. Writer. Futurologist. Aspiring dad. ). Learn why we included this. © 2021 LinkedIn Corporation, 1000 West Maude Avenue, Sunnyvale, CA 94085. LinkedIn and the LinkedIn logo are registered trademarks of LinkedIn. Created with publishthis.email Create simple web pages in seconds for free. This page was created in seconds, by sending an email to page@publishthis.email. Try it! Free. No account or sign-up required.

I'm curious how dukduckgo.com manages to pull this off--do you have your own data or reuse the google database? It's important

Re: 💡The week that crypto grew up

reading this, lmk if you ACK maSYN

On Thu, Aug 12, 2021 at 11:06 AM Azeem Azhar via LinkedIn <newsletters-noreply@linkedin.com> wrote:

Hi, I found it weird that the US infrastructure bill included so much, often...

|

|

|

Adam Marshall Dobrin

|

|

| |

|

|

NEWSLETTER ON LINKEDIN

Exponential View on LinkedIn

| | Open this article on LinkedIn to see what people are saying about this topic. Open on LinkedIn | |

💡The week that crypto grew up

Hi,

I found it weird that the US infrastructure bill included so much, often cacophonous detail, about crypto, but the ways of politics can be long-winded.

The topic was important enough so I sought out the best person who could help us understand what was going on. EVmember, Kevin Werbach is an erstwhile regulator, with a stint at the FCC when regulating the Internet was under discussion in the mid-1990s. He is also the author of one of the clearest books on the blockchain. Kevin also edited EV in August 2019 when I was on holiday. Please take a moment to thank Kevin and share his essay.

Since this piece was first published earlier this week, the Senate passed a $1.2 trillion infrastructure package as originally introduced a week before. The House of Representatives has the next vote, and there is bipartisan support for amending the bill, which might include amendments pushed for by the crypto community and lobbyists. For a timeline of what happened in the past two weeks, see this.

This essay was first published earlier this week to members of Exponential View. If you'd like to receive regular analysis of our shapeshifting world, become our member.

Azeem

This past week in Washington DC, an unstoppable force met an immovable object. The result wasn't what you might expect.

Blockchains and cryptocurrencies are often described as unstoppable, because their decentralized networks cannot be shut down and their smart contract transactions cannot be reversed. On the other side, policy-makers and regulators are seen as immovable, either because they bring to bear the coercive power of the state, or because they are simply too slow and dim-witted to adapt with the times.

Both views are exaggerations, of course. Progress occurs when discussions descend from ideologies to practicalities.

The immediate controversy was obscure: a provision in the Biden Administration's mammoth infrastructure bill defining cryptocurrency exchanges as "brokers" subject to tax reporting. Tightening up crypto trading tax compliance would supposedly raise $30 billion to offset spending. The language, though, was vague. It arguably could have swept in miners, wallet software or hardware providers, and others who couldn't do tax accounting for customers if they tried. Amendments were offered. Followed by counter-amendments. Followed by a flurry of lobbying and back-channel conversations. In the end, a compromise was reached, and then struck from the bill in an unrelated fight over military spending.

That the fight ended (for now) not with a bang but with a whimper should be cause for celebration. It's proof that legislators, even in the deeply polarized United States, can come together across party lines to address a highly technical issue related to a fast-developing new industry. Two other implications stand out.

First, crypto has arrived as a political force. Tech policy may never be the same. It was 26 years ago that a motley collection of activists and public interest organizations literally turned most of the popular pages on the World Wide Web black to protest the US Communications Decency Act. Their advocacy during the legislative process attracted attention. It helped spur a bipartisan amendment, Section 230, that gave service providers protection to innovate, and became a cornerstone of internet policy. (Albeit a controversial one today!) A unanimous Supreme Court struck down the remainder of the law. Since then, the Internet community has had seats at the table on important policy battles.

Given its libertarian bent, the crypto community has often bridled at engaging with governments. Fortunately, organizations such as Coin Center, the Chamber of Digital Commerce, and the Blockchain Association, all of which were involved in the infrastructure bill negotiations, took a more pragmatic view. Given its growing financial heft, the crypto community can be a powerful force for pro-innovation reform and individual empowerment in public policy debates. That is, if it can overcome its tendency to dismiss legitimate concerns about money laundering, fraud, and financial stability as craven excuses to protect incumbents.

The second takeaway is that the real fight over crypto is yet to come. The true point of contention around the infrastructure bill wasn't over shutting down Bitcoin or other digital assets (which no one was arguing), nor was it over whether crypto traders should have to pay taxes on their gains (which no one opposed). It was over something not mentioned in the bill at all: decentralized finance, or DeFi.

DeFi is a fast-growing sector of decentralized applications performing financial services functions such as lending and trading. From less than $1 billion at the start of 2020, DeFi protocols now manage roughly $60 billion of digital assets, with even bigger numbers when counting adjacent areas such as stablecoins, and non-fungible tokens (NFTs) for digital artwork and collectables.

\

While it's an exciting market, it's also a growing source of worry for regulators. DeFi protocols serve anyone indiscriminately (creating a challenge for financial crime and securities regulation), open up a host of vulnerabilities (resulting in hundreds of millions of dollars worth of losses already from hacks), create significant opportunities for scams, and generate interconnected risks that pose financial stability concerns.

The biggest problem with DeFi is that it potentially eliminates any touchpoint for regulation. Who is responsible when a service is a set of smart contracts running on their own on a blockchain? Janet Yellen's Treasury department didn't want to take DeFi regulation off the table with language that exempted developers and facilitators of those protocols. The battle is coming, though. In Europe, it's already here, with the proposed Markets in Crypto-Assets Regulation (MiCA) framework.

Whether one is an enthusiast or sceptic of crypto, the genie is out of the bottle. DeFi services will be deployed. Even with a major crash, there will be hundreds of billions of dollars of digital assets available to interact with them. It is difficult to write language covering DeFi facilitators that doesn't produce harmful spillovers in terms of government surveillance, speech regulation, and chilled innovation. This is the 20-year-old battle over peer-to-peer file-sharing reborn, with the stakes far greater.

The good news is that enough of the crypto community seems to be growing up. At the same time, governments are recognizing that the Trump Administration's strategy of doing nothing is actually long-term harmful to nascent industries. Regulatory uncertainty creates what Nobel Laureate (and Secretary Yellen's spouse) George Akerlof called the market for lemons; it removes the advantage of responsible actors, who are then crowded out by the bad apples.

For all its messiness and unsatisfying ending, the recent crypto controversy in Washington is a hopeful indication that we may yet follow a different path.

Kevin Werbach is a professor of Legal Studies and Business Ethics at the Wharton School, University of Pennsylvania, and formerly Counsel for New Technology Policy at the U.S. Federal Communications Commission. Kevin has spent the past two decades exploring major trends at the intersection of the Internet, digital media, and communications. He served on the Obama Administration's Presidential Transition Team and founded the Supernova Group. He has published four books, including The Blockchain and the New Architecture of Trust, For the Win: The Power of Gamification and Game Thinking in Business, Education, Government, and Social Impact, and After the Digital Tornado: Networks, Algorithms, Humanity.

Dig deeper:

- Decentralised Finance (DeFi) Policy-Maker Toolkit (WEF in collaboration with the Wharton Blockchain and Digital Asset Project, 2021)

- Banking Without Banks: Decentralised Finance is Coming (Exponential View Podcast, 2021)

- Bitcoin and the Future of Decentralised Finance (Exponential View Podcast, 2021)

\

| [

| |

Know someone who might be interested in this newsletter? Share it with them.

|

|

| |

|

| Unsubscribe | Help |

| |

|

You are receiving LinkedIn notification emails. The newsletter author can see that you are a subscriber.

| |

This email was intended for Adam Marshall Dobrin (Creative Director and ... Backseat Ferryman at XCALIBER DAO. Writer. Futurologist. Aspiring dad. ). Learn why we included this.

© 2021 LinkedIn Corporation, 1000 West Maude Avenue, Sunnyvale, CA 94085. LinkedIn and the LinkedIn logo are registered trademarks of LinkedIn.

|

|

|

|

Created with

publishthis.email

Create simple web pages in seconds for free.

This page was created in seconds, by sending an email to page@publishthis.email.

[

Try it!

](https://www.publishthis.email/)Free. No account or sign-up required.

-

- Jun 2020

-

www.editions-ellipses.fr www.editions-ellipses.fr

-

test Alex tag

-

- Jun 2019

-

arxiv.org arxiv.org

-

We describe an iterative procedure for optimizing

lyj hi!

-

- Mar 2019

-

www.desimartini.com www.desimartini.com

-

It was a crowded affair at the Jio World Centre with a galaxy of Bollywood stars in attendance. It included names like Amitabh Bachchan who came with wife Jaya and daughter Shweta Bachchan Nanda, Shah Rukh Khan who came with wife Gauri Khan, Aamir Khan and wife Kiran Rao, Kareena Kapoor Khan and sister Karisma Kapoor, Karan Johar, Ranbir Kapoor, Alia Bhatt, Aishwarya Rai Bachchan who came with husband Abhishek Bachchan and daughter Aaradhya, Priyanka Chopra Jonas who attended the function with mother Dr Madhu Chopra and brother Siddharth, Kiara Advani, Sidharth Malhotra, Rajinikanth and family to name a

hello

-

- Feb 2019

-

journal.fi journal.fi

-

Onkohan Journal.fi:llä muita Hypothes.is -verkkoannotointityökalun käyttäjiä minun lisäksi?

-

- May 2018

-

www.netofservice.com www.netofservice.com

-

Have it done

Testing

-

- Jun 2017

-

dev.plugnstage.com dev.plugnstage.com

-

tent here...

hi

-

- Jan 2017

-

albertorio.com albertorio.com

-

Contents

Hello World! Social reading is here.

-

- Oct 2016

-

hypothes.is hypothes.is

-

annotate

hi

-

-

hypothes.is hypothes.is

-

annotations

hi

Tags

Annotators

URL

-

-

hypothes.is hypothes.is

-

account

hello

Tags

Annotators

URL

-

- Jul 2015

-

Local file Local file

-

There has been some thinking in recent times that ICT based learning should supplement rather than replace the local teachers. In fact, ICT should alsobe used to enhance the capabilities of the local teachers and empower them in all possible

what note changes?

-

- Feb 2015

-

scalar.usc.edu scalar.usc.edu

-

ntum facilisis. Quisque facilisis tellus sapien, quis pharetra erat eleifend non. Cras ac lacinia metus. In cursus varius euismod. In ut tempor mauris. The Jetsons Praesent in orci pharetra, condimentum mauris sit amet, posuere mauris. Mauris turpis elit, lacinia id sollicitudin ornare, tristique ac sapien. Praesent eget ipsum nec velit rutrum pellentesque. Ut quis tincidunt lectus, et fermentum ante. Integer sapien elit, bibendum eu augue eget, fermentum accumsan lectus. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Integer dolor felis, volutpat sit amet lectus non, pharetra dignissim lacus. Quisque aliquet urna accumsan porta pulvinar.

-

- Oct 2014

-

www.poloniex.com www.poloniex.com

-

Hello world?

-

- Nov 2013

-

igor.gold.ac.uk igor.gold.ac.uk

-

Quizdeltagern

what is up with the wording here.

-

- Aug 2013

-

localhost:8080 localhost:8080

-

Robert J. Glushko et al

This is an annotation.

-

By Azeem Azhar

By Azeem Azhar