He says the future human will not be defined by shape or composition. For example, you might be 40% electronics and 60% human tissue.

for - future human - Michael Levin - the 6 million dollar man!

He says the future human will not be defined by shape or composition. For example, you might be 40% electronics and 60% human tissue.

for - future human - Michael Levin - the 6 million dollar man!

did she also recall the opening line of the novel Snoopy never did get to finish? “It was a dark and stormy night ….” Time didn’t allow me to explain that this was not actually a Snoopy original. The celebrated incipit was dognapped by Snoopy’s creator, Charles M. Schulz, from Edward George Earle Lytton Bulwer-Lytton, a mid-19th century English novelist, poet, playwright and politician who also coined phrases such as “the great unwashed”, “pursuit of the almighty dollar” and “the pen is mightier than the sword”.

If a dollar is valued at a lower level, then there will be specific sectors of the American economy that may be more competitive on global markets. Right. But everyone is hurt by a weaker dollar because also all of us in the United States are paid in dollars.

for - weaker US dollar tradeoffs - lower cost for foreign buyers BUT higher cost for domestic US consumers

there are people in the Trump administration orbit who actually view the dollar's role as the world's reserve currency, as bad for the U.S. economy, not an exorbitant privilege, but something that undermines our export competitiveness

for - adjacency - US reserve currency - Some in Trump admin see it as a bad thing - question - Does Trump admin want to intentionally devalue US dollar and US reserve currency status?

comment - They want to devalue the US dollar so that US goods are more competitive - lower cost

Treasury yields have gone up as the dollar's value has actually weakened as normally you'd expect as Treasury yields go up, that the dollar would strengthen because there would be more demand for American assets.

for - why - increase in treasury yields normally strengthens US Dollar - Gemini AI gives a good explanation - Yes, it's generally expected that when U.S. Treasury yields increase, the value of the US dollar will strengthen. - This is because higher yields attract more foreign investment, increasing demand for the dollar to purchase those assets. - Higher yields ( higher interest rate) mean more attractive returns: - When Treasury yields rise, the returns on U.S. government bonds become more appealing to investors, both domestic and foreign. - Increased demand for US dollars: - As investors from other countries seek to buy these higher-yielding U.S. assets, they need to first convert their local currencies into US dollars to make the purchase. - This increased demand for dollars strengthens its value. - Safe-haven status: - During times of economic uncertainty, investors often flock to safe-haven assets like U.S. Treasuries. This further boosts the demand for the US dollar, as it is the currency used to hold these assets. - Currency Valuation - A strong currency indicates a healthy economy and can attract more foreign investment. This creates a positive feedback loop, as a stronger dollar can further boost investor confidence and lead to even higher demand for US assets.

Explain that. Carry that out for people who would be like, I'm not making the connection because I think so much of what's happened in the last week and a half, we have to understand how this all connects,

for - question - clarify for the audience how the US dollar as reserve currency, the decrease in demand for US treasury bonds and the US national debt are related to Trump's tariffs?

comment - The interviewer asks a great question on behalf of the audience as she understands that a lot of people don't understand the significance of Trump's tariff on the US national debt, treasury bonds and the US reserve currency. - She asks him to connect the dots and reveal the salient adjacencies

what would it mean for the dollar to lose its position as the world's reserve currency?

for - question - what would it mean for the dollar to lose its position as the world's reserve currency? - answer - if nobody buys US treasury bonds because it is no longer seen as a safe haven, and even begin liquidating them, then they can no longer compensate for the annual interest payment of the US national debt - The US would be forced to actually balance its budget

he dollar as role as the world's reserve currency is necessary for the way that we run our political economy,

for - impacts - of US dollar losing role as world reserve currency - can no longer fund US deficit and must balance the budget - lose geopolitical leverage of sanctions

real concerns that the dollar may be losing some of its safe haven status.

for - US dollar - losing safe haven status - de-dollarization - selling off US treasury bonds

It is likely that Trump and Musk are seeking to crash the US economy to cause a Depression. This will allow transnational wealth holders — the billionaire class — to buy up “distressed assets” in the US for cheap.

for - to - largest wealth transfer in US history - bankrupt farms - pennies on the dollar - https://hyp.is/rXHfUgHPEfC5s2-peCc-5Q/www.youtube.com/watch?v=Fg4E3Py8OT4

for - adjacency - US farm bankruptcy - land grab - billionaires - adjacency - largest wealth transfer in history - US farmers bankruptcy - billionaire purchase pennies on the dollar

will that not affect the value of the dollar he said no not as long as it is the only World Reserve currency the only currency that has demand people demand it even if they don't want to buy anything from the country which is producing it which is printing it

for - key strategy - US foreign policy - US dollar don't devalue as long as it is the world's reserve currency - even if they don't want to buy from you - Yanis Varoufakis

The infamous Apple typewriter memo is 40 years old ... by [[Richard Polt]]

50:32 Currency is the governments I.O.U. 52:04 When the government gets its tax, it no longer has the debt so it burns the currency which was an I.O.U.

44:17 Private Balance + Government Balance + Foreign Balance = 0 (I-S)+(G-T)+(X-M)=0

Typewriter Tool Kit from the DOLLAR TREE by [[Just My Typewriter]]

Overview of cheap tools for typewriters available at Dollar Tree and similar dollar stores.

Gladwell, Malcolm. “Million-Dollar Murray.” The New Yorker, February 5, 2006. https://www.newyorker.com/magazine/2006/02/13/million-dollar-murray (.pdf copy available at https://housingmatterssc.org/million-dollar-murray/)

The underlying theme tyingthese myths together is that poverty is often perceived to be an issue of“them” rather than an issue of “us”—that those who experience povertyare viewed as strangers to mainstream America, falling outside accept-able behavior, and as such, are to be scorned and stigmatized.

One of the underlying commonalities about the various myths of poverty is that we tend to "other" those that it effects. The "them" we stigmatize with the ills of poverty really look more like "us", and in fact, they are.

Rather than victim shame and blame those in poverty, we ought to spend more of our time fixing the underlying disease instead of spending the time, effort, energy, and money on attempting to remedy the symptoms (eg. excessive policing, et al.) Not only is it more beneficial, but cheaper in the long run.

Related:<br /> Gladwell, Malcolm. “Million-Dollar Murray.” The New Yorker, February 5, 2006. https://www.newyorker.com/magazine/2006/02/13/million-dollar-murray (.pdf copy available at https://housingmatterssc.org/million-dollar-murray/)

There was also never a default. Colombo arranged a bailout from the International Monetary Fund, and decided to raise much-needed dollars by leasing out the underperforming Hambantota Port to an experienced company—just as the Canadians had recommended. There was not an open tender, and the only two bids came from China Merchants and China Harbor; Sri Lanka chose China Merchants, making it the majority shareholder with a 99-year lease, and used the $1.12 billion cash infusion to bolster its foreign reserves, not to pay off China Eximbank.

Evergrande group has more than $300bn of liabilities, about $20bn of which are offshore dollar-denominated bonds. The Chinese government has focused on completing work on its hundreds of projects, where homes have typically been sold to ordinary buyers before completion.

This home at 1384 Goldsmith Dr. in Westerville sold on June 13.

Sold for over $500,000 and is missing a shutter. 🤦♂️

Correa, R., Du, W., & Liao, G. Y. (2020). U.S. Banks and Global Liquidity (Working Paper No. 27491; Working Paper Series). National Bureau of Economic Research. https://doi.org/10.3386/w27491

Rather than acting through a model of exclusion or opposition, ‘normalisation’ assimilates the ‘abnormal’ as part of the ‘normal’ state and its proper function, turning the body into an object of strict control and under constant surveillance.

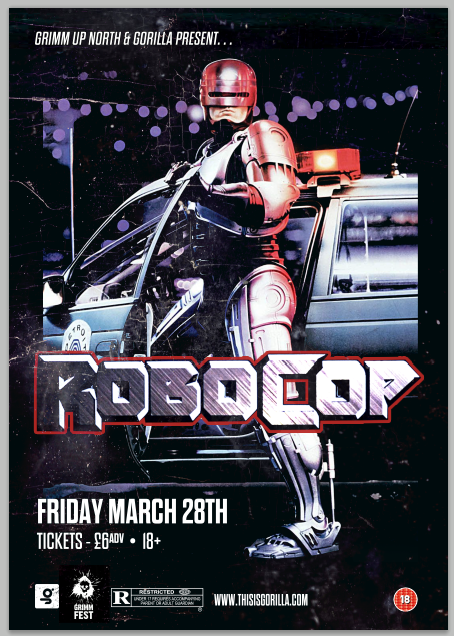

These same anxieties are the focus of so many post-human science fiction films (particularly those from the 80's) where an abnormal human body is normalized. The language of this passage especially reminded me of Robocop where the protagonist effectively loses control over his body and is constantly surveilled by his corporate creators.